Get instant loan offer suitable to your profile !

On this Page:

Want to take an education loan but worried about the hurdles in the process? Read about the issues and their possible solutions in this blog.

“Congratulations! Your loan application has been approved”. This is a statement that instantaneously changes the mood of every student. As relief washes over them, they forget that the education loan hill is only half-climbed. There are many more steps after receiving the loan sanction letter; many of which can create delays and problems in the process. Lenders can withhold the disbursement, reduce the sanctioned amount, or even reject the loan post-sanction.

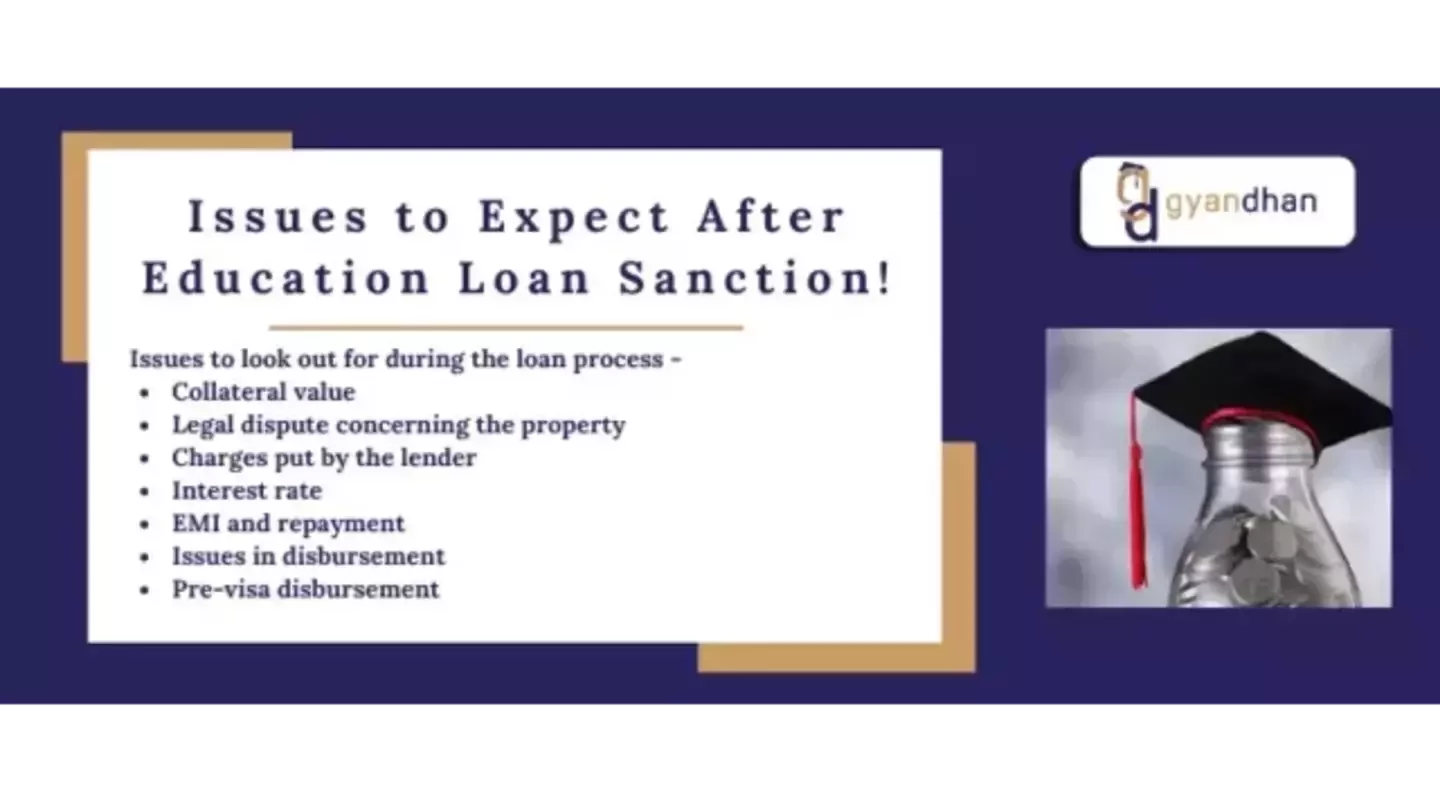

Let’s figure out the issues to expect after education loan sanction and ways to avoid these roadblocks -

A loan application to public banks with a loan amount of INR 7.5 lakhs and above requires collateral. The collateral/property is evaluated by a bank-appointed evaluator, which means that the valuation of the property will be lower than the market value. This is because the loan tenures are for 5 to 10 years, and therefore, the loan to value ratio is restricted to 70 to 80 percent of the property’s market value.

To know more about Types of Collateral Security Acceptable for an Education Loan, click here.

While the value of the collateral is evaluated before t,he loan sanction, make sure that the value is more than the loan amount required, and the collateral papers are complete. Original documents are to be submitted after the loan is sanctioned. Arranging the collateral papers is a task that troubles even the best of people, and even if one document is missing, the loan process is jeopardized. It is better to take the help of GyanDhan’s executive while submitting the documents for a smooth process.

To know more about Documents Required for Education Loan, click here.

Pledging collateral ensures a higher loan amount limit, lower rates of interest, and better terms and conditions. But if the property pledged is under any dispute - legal or otherwise - it won’t be processed and accepted by the lender. The property should not be under any dispute and the property papers should clearly indicate the owner of the property. If you face this problem, get in touch with GyanDhan and we will help you with documentation and submission.

To know more about Collateral Security for Education Loan, click here.

Several charges are put by the lender during the loan process. The student should keep a track of all the account statements to be on top of them. Students often face the issue of unnecessary charges being put without reason and find it difficult to connect with their respective lenders. This happens because most bank managers get transferred within 2-3 years, and the loan runs approximately 7-8 years. This problem does not occur if the loan is taken via GyanDhan as the executive stays on top of your case till the last repayment.

To know more about Education Loan Process for Abroad Studies, click here.

The interest rate on education loans is floating, which means that it can increase or decrease depending on the market conditions. This sudden flux is most common in student loans from private lenders, like NBFCs and private banks. Because of this, several students face the issue of a sudden increase in rates. Students either end up paying high EMIs or struggle to refinance their loans at a lower rate of interest. If you are struggling with higher rates and refinancing the loan, simply get in touch with us. Our team of experts will get you the best deal possible at lower rates and better terms.

Some of the major issues faced by the student after loan sanction are EMIs and loan repayment. EMI not getting deducted after the moratorium period, when to start repayment, when to postpone the repayment, how much to repay, etc., could and will plague a student.

To know more about How To Repay Your Education Loan Faster, click here.

These issues can be easily resolved by the GyanDhan team. If you are facing any issue related to the repayment of the loan, EMIs, or the postponement, get in touch with us if you applied for the loan via us. Unfortunately, we do not have any say in the matter if the application did not go through us.

Took an education loan for Germany, but the lender is refusing to disburse the amount for the block account? This and other disbursement issues are quite common after the loan is sanctioned. You could face delays in disbursement, problems in the second disbursement, etc., which will be resolved by our team swiftly. Our services start when you get in touch with us and end when you repay the last EMI. So, contact us anytime you face any issue with loan disbursement.

Similar to Germany, countries like the USA, Canada, UK require the students to submit proof of funds that show liquid funds in their account. For this particular reason, pre-visa disbursement becomes a requirement that should be conveyed to the lender beforehand. However, several students still face this issue wherein the lender refuses to disburse the amount before the visa is approved. GyanDhan makes this step easy and resolves any issue that a student might face during pre-visa disbursement.

These are some of the common issues that a student can face after successfully getting the sanction letter. As said earlier, a sanction letter is a hill only half-climbed. To complete the rest of the process without any hassle, get in touch with us. We do not assure you that you won’t face any hurdles during the process, though it is what we strive for. But when you do face these problems, we will resolve them without causing any delay in the process. So get in touch with us today and start your loan process with the assurance that you will get the funds you need for your education.

As always, our services are free of cost. Though, we won’t mind an honest Google review.

Read Also:

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat