Get instant loan offer suitable to your profile !

On this Page:

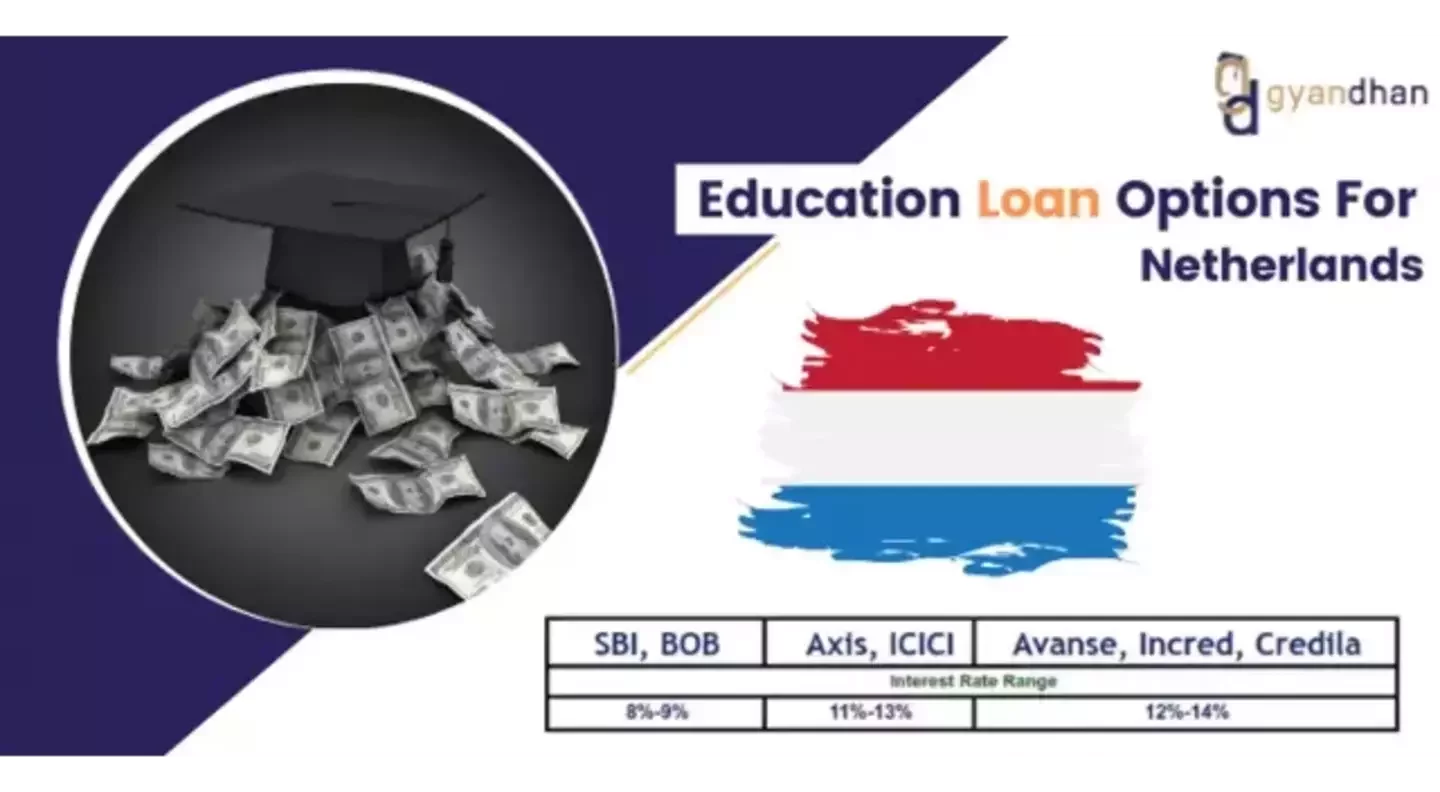

Explore education loan options for studying in the Netherlands. Learn about eligibility, interest rates, and loan providers to fund your dream education abroad.

In the academic year 2021-22, there was a notable 12% increase in international student admits. According to the Indian Ministry of External Affairs, the number of Indian students enrolling in the country exceeded 1,900 during the same period. It is expected that this figure will continue to rise in the coming years, solidifying Netherlands' status as an emerging hotspot for studying abroad.

Although the cost of studying in the Netherlands is relatively low compared to other popular study-abroad destinations like the USA, UK, and Canada, it still requires some financial backing when compared to the Indian subcontinent. In this blog, we will discuss how to manage the financial aspects of studying in the Netherlands.

Before we tell you about the different lending options that you can opt for let’s first understand the different expenses that you would have to bear when you decide to study abroad in Netherlands. The cost to study in Netherlands comprises two components i.e. tuition fees and cost of living in Netherlands. The tuition fees based on different programs offered in Netherlands are shown in the table below:

| Program | Tuition Fees per year |

|---|---|

|

Bachelor’s Degree |

6,000 EUR - 15,000 EUR |

|

Master’s Degree |

8.000 EUR - 20,000 EUR |

Private universities tend to have higher tuition fees, often around 30,000 EUR, which is relatively higher when compared to the fees charged by public universities. The next component in the cost to study in Netherlands is the cost of living. An overview of monthly expenses that you may have to bear is showcased in the table below -

| Expense | Cost (Monthly) |

|---|---|

|

Accommodation |

400 EUR -1000 EUR |

|

Food |

150 EUR - 170 EUR |

|

Transportation |

40 EUR – 80 EUR |

|

Internet |

30 EUR – 50 EUR |

|

Miscellaneous |

150 EUR – 200 EUR |

|

Total Expenses |

770 EUR - 1500 EUR |

It is essential that a student must be aware of the eligibility criteria and that they are able to fulfill all the requirements as per these eligibility criteria. Although every lender has a different set of eligibility criteria that you would be required to meet but a general idea has been shown below -

The applicant must be an Indian citizen and must be at least 18 years of age.

The applicant must be an Indian citizen and must be at least 18 years of age.

The applicant must be enrolled in a full-time program at a reputable Netherlands university.

The applicant must be enrolled in a full-time program at a reputable Netherlands university.

Applicant must have appeared for the English proficiency test.

Applicant must have appeared for the English proficiency test.

Should have a financial co-applicant and a strong career prospect in case of an unsecured education loan.

Should have a financial co-applicant and a strong career prospect in case of an unsecured education loan.

Must possess collateral either equal or more in value to the required loan amount in the case of a secured education loan.

Must possess collateral either equal or more in value to the required loan amount in the case of a secured education loan.

A set of documents are required in order to proceed with your loan application for the Netherlands. Below are some of the documents that you may need for getting the loan. They are -

Letter of admission from the University

Letter of admission from the University

Fully filled out loan application form

Fully filled out loan application form

Documents on the cost of studies

Documents on the cost of studies

Identification proof

Identification proof

Residence proof

Residence proof

PAN details of the candidate

PAN details of the candidate

Guarantor/ co-borrower/ student's bank statements

Guarantor/ co-borrower/ student's bank statements

Guarantor/ co-borrower/ student's statement of assets

Guarantor/ co-borrower/ student's statement of assets

Guarantor/ co-borrower/ student's proof of income

Guarantor/ co-borrower/ student's proof of income

Secured education loans for studying in the Netherlands require applicants to provide collateral/security. Such loans are commonly referred to as education loan with collateral. Collateral can include assets like property (e.g., house or land), fixed deposits (FDs), or insurance policies. These loans come with various advantages, including lower interest rates, extended repayment periods, and the possibility of higher approved loan amounts.

Public sector banks are often favored over private banks and NBFCs due to their attractive features, such as larger loan amounts, lower interest rates, and additional benefits. Below is a table presenting a comparison of different lenders and their offerings for secured education loans.

The Netherlands offers a 15-year repayment tenure for secured loans, with a moratorium covering the study duration plus one additional year. For example, if you secured a loan of 25 lakhs at an 8.5% interest rate with a repayment term of 10 years, your repayment schedule would look like this, starting after the moratorium period ends.

| Repayment schedule | EMI | Interest portion | Loan Outstanding | Principal portion |

|---|---|---|---|---|

|

End of 1st year |

34317 |

18418 |

15899 |

2584254 |

|

End of 2nd year |

34317 |

17012 |

17305 |

2384444 |

|

End of 3rd year |

34317 |

15483 |

18834 |

2166972 |

|

End of 4th year |

34317 |

13818 |

20499 |

1930278 |

|

End of 5th year |

34317 |

12006 |

22311 |

1672662 |

|

End of 6th year |

34317 |

10034 |

24283 |

1392275 |

|

End of 7th year |

34317 |

7888 |

26430 |

1087105 |

|

End of 8th year |

34317 |

5551 |

28766 |

754960 |

|

End of 9th year |

34317 |

3009 |

31308 |

393457 |

|

End of 10th year |

34317 |

241 |

34076 |

0 |

An unsecured education loan for studying in the Netherlands is known as an education loan without collateral since it does not demand any security or pledging of assets. However, due to its unsecured nature, the interest rates may be slightly higher compared to loans offered by public sector banks.

When considering education loans for Netherlands, you have three types of lenders to choose from private banks, NBFCs, and international lenders. The table below illustrates the specific offerings provided by each type of lender.

| Lender Name | Maximum Loan Amount | Rate of Interest | Margin Money |

|---|---|---|---|

|

Up to 50 Lakhs INR |

11% - 13.50% |

5% |

|

|

Up to 50 Lakhs INR |

10.85% - 12.50% |

0 - 15% |

|

|

Up to 35 Lakhs INR |

11.75% - 13.25% |

Nil |

|

|

Up to 20 Lakhs INR (Only STEM Courses) |

12% - 13% |

Nil |

|

|

Up to 20 Lakhs INR (Only STEM Courses) |

12.75% - 13.25% |

Nil |

|

|

Up to 100,000 USD |

12% - 14% |

Nil |

Once your moratorium period is over, you will need to start repaying your unsecured education loan with monthly installments over a 10-year period. Say for instance, if you borrow INR 35 lakhs at an interest rate of 11.25% for 10 years, your repayment schedule will be based on these terms.

| Repayment schedule | EMI | Interest portion | Loan Outstanding | Principal portion |

|---|---|---|---|---|

|

End of 1st year |

58684 |

37462 |

21222 |

3974695 |

|

End of 2nd year |

58684 |

34947 |

23737 |

3703962 |

|

End of 3rd year |

58684 |

32135 |

26549 |

3401152 |

|

End of 4th year |

58684 |

28989 |

29695 |

3062462 |

|

End of 5th year |

58684 |

25471 |

33214 |

2683643 |

|

End of 6th year |

58684 |

21535 |

37149 |

2259938 |

|

End of 7th year |

58684 |

17134 |

41550 |

1786031 |

|

End of 8th year |

58684 |

12210 |

46474 |

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat