Get instant loan offer suitable to your profile !

On this Page:

Foreign education loans for Indian students ✓Check eligibility ✓Documents required for with or without collateral loan ✓compare top lenders for international courses

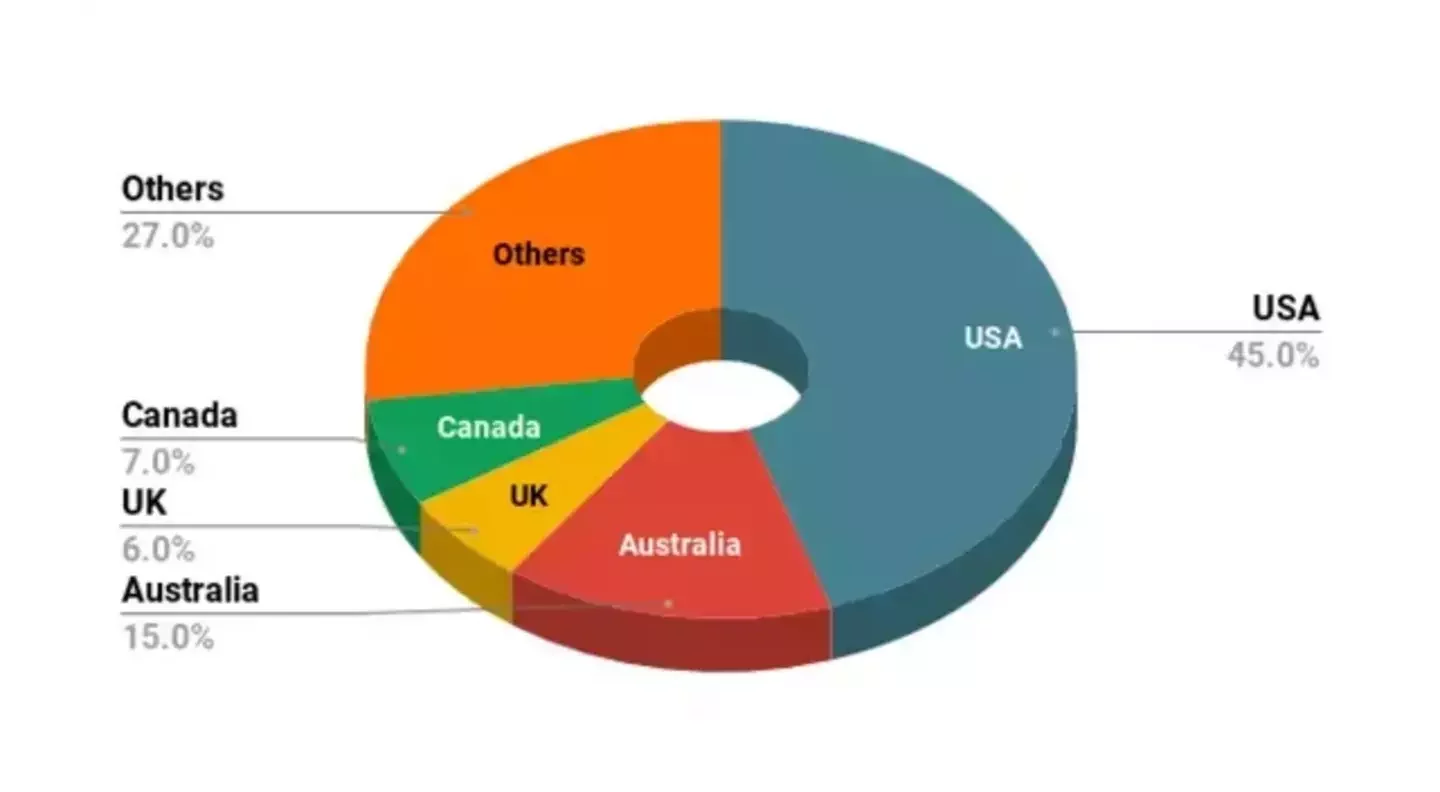

Which Foreign Country Indian Students Picked the Most?

Why such an exodus of students for foreign studies? Because international education is a life-changing experience. It alters your entire career path for the better, which is why more and more Indian students aspire to it.

But accessing a foreign degree hinges upon a student’s ability to afford it. Considering the astronomical cost of studying in the best international universities, it is not within the reach of all. A simple solution for such students is a foreign studies loan.

A student who hopes to finance his/her studies with an education loan has two options – an education loan with collateral or an education loan without collateral.

An education loan that asks for an asset as a guarantee is called a secured loan. The asset can be a property, FD, land, LIC Insurance, etc. The asset, called collateral, acts as a security for the lender if the student fails to repay the loan. Foreign education loans with collateral have:

Lower Interest Rate

Lower Interest Rate

Higher Sanction Amount

Higher Sanction Amount

Longer Repayment Time

Longer Repayment Time

No Repayment During the Study Period

No Repayment During the Study Period

They are also much easier to get than education loans without collateral. These loans for foreign studies are offered by:

Public Sector Banks

Public Sector Banks

Private Banks

Private Banks

Non-banking Financial Companies (NBFC)

Non-banking Financial Companies (NBFC)

An education loan that doesn’t require you to promise an asset as security is called an unsecured loan. Like secured loans, these are offered by private banks, NBFCs, and public banks. But the maximum amount for which an unsecured education loan is offered by nationalised banks is INR 7.5 Lakhs, which is never sufficient to bear the full cost of education from a foreign country. Education loans without collateral for foreign studies have:

Higher Processing Fee

Higher Processing Fee

Higher Rates of Interest

Higher Rates of Interest

Partial Payments during the Repayment Period

Partial Payments during the Repayment Period

| Features | Public Banks | Private Banks | NBFCs |

|---|---|---|---|

|

Example Lenders |

|||

|

Maximum Amount |

Upto INR 1.5 crore |

Upto INR 60 lacs |

Upto INR 50 lacs |

|

Interest Rate Range* |

8.85%-10.25% |

11%-13% |

12%-14% |

|

Processing Fees (INR) |

INR 11800 |

No fee for loan above INR 20 lacs and INR 750 on each lac above a loan of INR 20 lacs |

1%-2% loan amount |

|

Payment During Study Period |

None |

Simple Interest |

Simple Interest |

Check Your Education Loan Eligibility

Period for Repayment - Secured foreign education loans from public banks have a 15-year repayment tenure. The same for NBCFs and private banks is 10 years and 20 years respectively.

Period for Repayment - Secured foreign education loans from public banks have a 15-year repayment tenure. The same for NBCFs and private banks is 10 years and 20 years respectively.

Time for Processing - A foreign study loan with collateral from a public bank takes 12-15 days to process but only 8-10 days from a private bank. NBFCs have an even shorter processing time of 5-7 days.

Time for Processing - A foreign study loan with collateral from a public bank takes 12-15 days to process but only 8-10 days from a private bank. NBFCs have an even shorter processing time of 5-7 days.

Coverage of Expenses - A public bank covers 90%-100% of the costs, but private banks cover only 86%. Most NBFCs sanction a loan for 100% of the expenses.

Coverage of Expenses - A public bank covers 90%-100% of the costs, but private banks cover only 86%. Most NBFCs sanction a loan for 100% of the expenses.

Reasons for Decline - Public banks will reject a foreign studies loan if the collateral documents are incomplete. Private banks will reject an education loan for incomplete documents and low CIBIL score. NBFCs mainly state CIBIL and low income as reasons for the decline.

Reasons for Decline - Public banks will reject a foreign studies loan if the collateral documents are incomplete. Private banks will reject an education loan for incomplete documents and low CIBIL score. NBFCs mainly state CIBIL and low income as reasons for the decline.

A simple way to increase your chances of loan approval by 50% is to take the help of GyanDhan. Our loan counselors assess your profile, pick the most suitable education loan option for you, and then contact that lender who is most likely to approve your application.

The documents required for a secured foreign studies loan are somewhat different from those required for an unsecured loan:

Fee Structure

Fee Structure

Admission Proofs

Admission Proofs

Property (collateral) Documents

Property (collateral) Documents

Relevant Mark Sheets of Applicant

Relevant Mark Sheets of Applicant

Bank Statements of the co-applicant

Bank Statements of the co-applicant

KYC of the Applicant and co-applicant

KYC of the Applicant and co-applicant

Income Tax Documents/Form 16 of the co-applicant

Income Tax Documents/Form 16 of the co-applicant

Basic Academic Qualification records of the applicant

Basic Academic Qualification records of the applicant

Citizenship and Residence Proofs of the Applicant and Co-applicant

Citizenship and Residence Proofs of the Applicant and Co-applicant

The loan application documents don’t just vary from bank to bank but also according to the collateral. Any student struggling with this step can consult GyanDhan. We give you a customised list of documents required by your lender. It ensures that your application is submitted in one go.

| Features | Public Banks | Private Banks | NBFCs |

|---|---|---|---|

|

Lenders |

|||

|

Maximum Amount |

Not applicable |

Upto INR 40 lacs |

Upto INR 25 lacs |

|

Interest Rate Range |

Not applicable |

11.25%-13% |

12%-14% |

|

Processing Fees (INR) |

Not applicable |

No fee for loan < 20 lacs and INR 750 on each lac above a loan above INR 20 lacs |

1%-2% loan amount |

|

Number of Colleges Supported |

Not applicable |

More than 100 |

More than 200 |

Check Your Education Loan Eligibility

Period for Repayment - For unsecured education loan in India for foreign studies, 20 years is the maximum repayment period given by private banks. NBFCs offer just 10 years. You can get a customised foreign loan with the help of GyanDhan by requesting an extension of repayment tenure, which we take care of on your behalf.

Period for Repayment - For unsecured education loan in India for foreign studies, 20 years is the maximum repayment period given by private banks. NBFCs offer just 10 years. You can get a customised foreign loan with the help of GyanDhan by requesting an extension of repayment tenure, which we take care of on your behalf.

Time for Processing - Private banks take 5-7 days to process unsecured foreign education loans. If there is a delay on the part of the lender, GyanDhan contacts the lending institution and hastens the process to ensure timely sanction of the loan.

Time for Processing - Private banks take 5-7 days to process unsecured foreign education loans. If there is a delay on the part of the lender, GyanDhan contacts the lending institution and hastens the process to ensure timely sanction of the loan.

Coverage of Expenses - A loan from an NBFC can cover 100% of your expenses, while a private bank covers about 85%. If your selected country (like Germany) requires sufficient living expense funds to be put in a blocked account, GyanDhan ensures that the step is completed without any hassle to you.

Coverage of Expenses - A loan from an NBFC can cover 100% of your expenses, while a private bank covers about 85%. If your selected country (like Germany) requires sufficient living expense funds to be put in a blocked account, GyanDhan ensures that the step is completed without any hassle to you.

Income Requirement of Co-applicant - Education loans without collateral for foreign studies from both private and public banks require a co-applicant monthly income of over INR 35,000. However, the precise income requirement does alter according to the loan amount. Our experience says, 50% of the income is sufficient to bear the interest per month in the case of NBFCs. For banks, this number is 65%.

Income Requirement of Co-applicant - Education loans without collateral for foreign studies from both private and public banks require a co-applicant monthly income of over INR 35,000. However, the precise income requirement does alter according to the loan amount. Our experience says, 50% of the income is sufficient to bear the interest per month in the case of NBFCs. For banks, this number is 65%.

Reasons for Decline - There are two common reasons a private bank or NBFC decline foreign studies education loan - a) The co-applicants monthly income is not adequate to remit the interest during the period of studying b) Poor CIBIL Score of the applicant. If your CIBIL score is weak, it does not completely reduce your chances of getting an education loan. GyanDhan’s counsellor can come up with solutions for you to cross the hurdle and get your loan sanctioned.

Reasons for Decline - There are two common reasons a private bank or NBFC decline foreign studies education loan - a) The co-applicants monthly income is not adequate to remit the interest during the period of studying b) Poor CIBIL Score of the applicant. If your CIBIL score is weak, it does not completely reduce your chances of getting an education loan. GyanDhan’s counsellor can come up with solutions for you to cross the hurdle and get your loan sanctioned.

a) The co-applicants monthly income is not adequate to remit the interest during the period of studying

a) The co-applicants monthly income is not adequate to remit the interest during the period of studying

b) Poor CIBIL Score of the applicant. If your CIBIL score is weak, it does not completely reduce your chances of getting an education loan. GyanDhan’s counsellor can come up with solutions for you to cross the hurdle and get your loan sanctioned.

b) Poor CIBIL Score of the applicant. If your CIBIL score is weak, it does not completely reduce your chances of getting an education loan. GyanDhan’s counsellor can come up with solutions for you to cross the hurdle and get your loan sanctioned.

When you fill out an application for an unsecured loan for foreign studies, the lender asks you to submit distinct documents. The precise list varies from bank to bank and student to student, but typically the papers required are:

Fee Structure

Fee Structure

Admission Proof

Admission Proof

Bank Statements of the co-applicant

Bank Statements of the co-applicant

Income Tax Return of the co-applicant

Income Tax Return of the co-applicant

KYC of the Applicant and co-applicant

KYC of the Applicant and co-applicant

Basic Academic Qualification Records of the applicant

Basic Academic Qualification Records of the applicant

Citizenship and Residence Proofs of the Applicant and co-applicant

Citizenship and Residence Proofs of the Applicant and co-applicant

Gathering the documents is one of the most complicated steps of an education loan application process. If you’re floundering in an ocean of paperwork and unsure of which documents to submit, GyanDhan can provide the customized list of documents for your favoured lender and expedite the process.

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat