Get instant loan offer suitable to your profile !

On this Page:

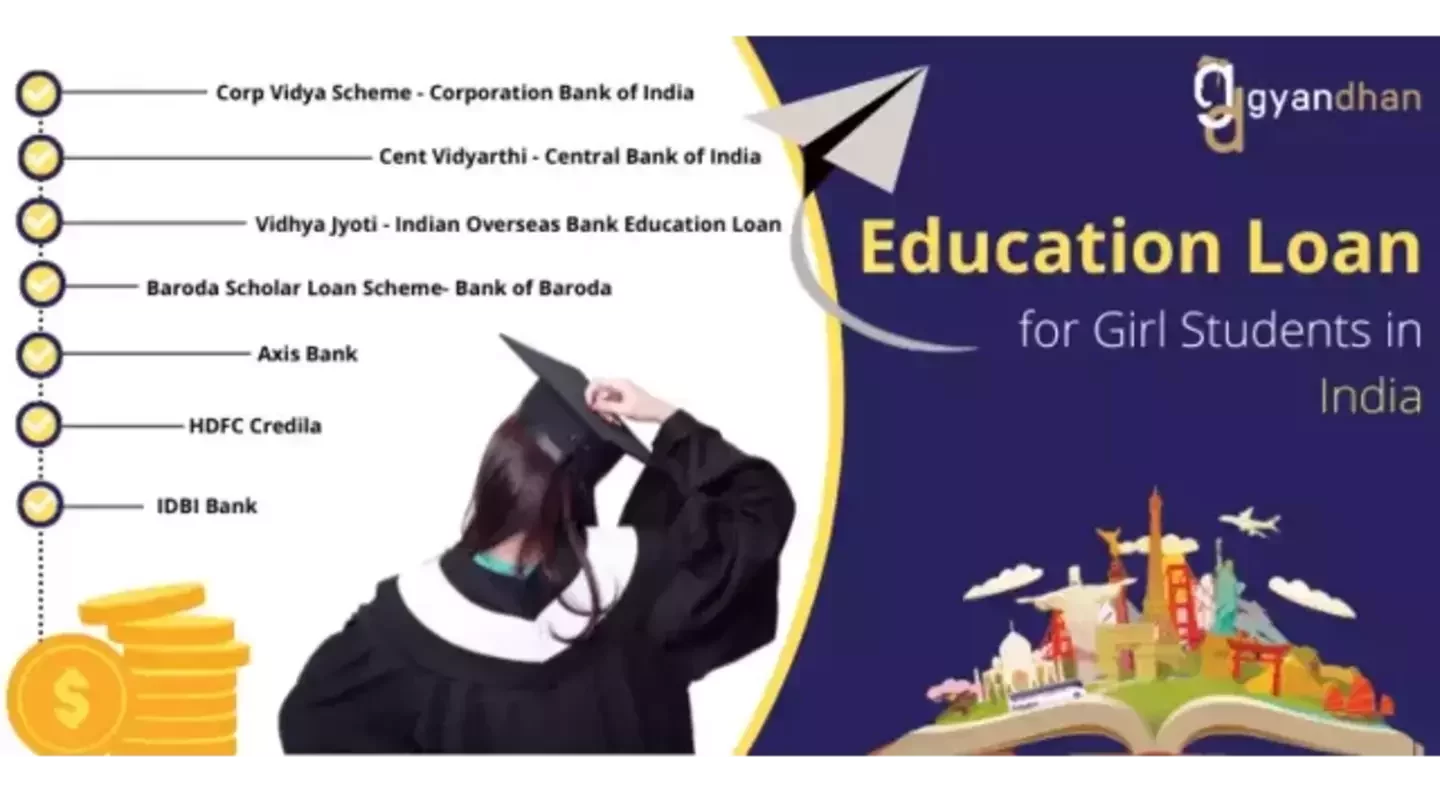

Read GyanDhan’s guide on education loans and Indian government schemes for women's education. Discover education loans and schemes designed specially for girls.

Education is a pivotal stepping stone towards empowerment, and ensuring that girls have access to quality education is crucial for societal advancement. In India, a variety of education loans and schemes have been specifically tailored to encourage more girl students to pursue higher education without financial constraints. Education loan for girl students in India by the government are specially tailored for female applicants to fulfill their specific needs.

Several public and private banks come forward with handpicked schemes for girls' higher education. Despite their goal being the same, the education loan for girl students available in the market differs slightly from one another.

Check Your Education Loan Eligibility

Did you know that several public banks provide a 0.5% concession on interest rates on education loan for girl students in India? Yes, you read that right. Having a comparative understanding of the education loan for girl students in India would help aspirants like you in choosing the best-suited option.

| Bank | Interest Rate for Female Applicants |

|---|---|

|

10.15% |

|

|

9.25% |

|

|

8.60% |

|

|

10.25% |

|

|

8.10% |

To promote gender equality and empower women through education, the Indian government has initiated various schemes specifically targeting women's education. These Indian government schemes for women's education aim to alleviate the financial burdens that often prevent girls from accessing higher education.

Beti Bachao, Beti Padhao Yojana is a flagship initiative introduced by the Government of India aimed at promoting the welfare of girl children. The scheme focuses on raising awareness and improving the efficiency of welfare services intended for girls in India.

Eligibility criteria:

The scheme is generally targeted at the district level, focusing on districts with low Child Sex Ratio (CSR).

The scheme is generally targeted at the district level, focusing on districts with low Child Sex Ratio (CSR).

It encompasses all the girl children born in these districts.

It encompasses all the girl children born in these districts.

Parents and guardians of girl children in these districts are encouraged to participate in the scheme to avail of the various benefits that are geared towards improving the girl child's welfare and education.

Parents and guardians of girl children in these districts are encouraged to participate in the scheme to avail of the various benefits that are geared towards improving the girl child's welfare and education.

Offered by the All India Council for Technical Education (AICTE), the Pragati Scholarship Scheme is specifically designed for girl students who aspire to pursue technical education. It aims to empower young women by providing them with financial assistance to continue their technical education.

Eligibility criteria:

The scholarship is available to girl students who are admitted to the first year of their diploma/degree course or the second year of their diploma/degree course through lateral entry in any of the AICTE-approved institutions.

The scholarship is available to girl students who are admitted to the first year of their diploma/degree course or the second year of their diploma/degree course through lateral entry in any of the AICTE-approved institutions.

Candidates should be of Indian nationality.

Candidates should be of Indian nationality.

The family income of the applicant should not exceed Rs. 8 lakh per annum during the preceding financial year. In the case of married girls, the income of the parents/in-laws, whichever is higher, will be considered.

The family income of the applicant should not exceed Rs. 8 lakh per annum during the preceding financial year. In the case of married girls, the income of the parents/in-laws, whichever is higher, will be considered.

SSY is a government-backed savings scheme that encourages parents to invest in a bright future for their daughters. It offers attractive interest rates and tax benefits, making it a lucrative option for parents to save for their daughter’s future educational needs and marriage expenses.

Eligibility criteria:

The account can be opened by the parents or legal guardian of a girl child until she reaches the age of ten.

The account can be opened by the parents or legal guardian of a girl child until she reaches the age of ten.

Only one account can be opened per girl child and a maximum of two accounts in the name of two different girl children can be opened in a family (a third is allowed in cases of twins/triplets).

Only one account can be opened per girl child and a maximum of two accounts in the name of two different girl children can be opened in a family (a third is allowed in cases of twins/triplets).

The account can be opened with a minimum deposit of Rs. 250 and a maximum of Rs. 1.5 lakh can be deposited in a financial year.

The account can be opened with a minimum deposit of Rs. 250 and a maximum of Rs. 1.5 lakh can be deposited in a financial year.

These schemes are part of broader efforts to enhance the educational and social status of girls in India, providing them with the tools they need to succeed and excel in their chosen fields.

These schemes are part of broader efforts to enhance the educational and social status of girls in India, providing them with the tools they need to succeed and excel in their chosen fields.

Securing an education loan can significantly ease the financial burden associated with higher education. Education loan for girls are often more accessible and come with benefits such as lower interest rates. These advantages make it feasible for many girls to pursue their dream educational courses, both in India and abroad.

If you are someone who wants to study abroad but finances are holding you back then GyanDhan is here to help you navigate through the education loan process. Check your loan eligibility now and our expert education loan counselors will take it forward.

Calculate your Education Loan EMI

Real Also

To get an education loan for girl students in India without collateral, applicants can check the official websites of banks and NBFCs or directly apply from here.

Several public banks including the State Bank of India, Bank of Baroda, and Punjab National Bank, along with private banks like IDBI Bank and ICICI Bank, offer a 0.5% interest concession on education loans for girl students

Yes, some banks offer flexible repayment options such as extended moratorium periods, which allow students to start repaying the loan after completion of their studies, and graduated repayment options that can adjust according to the earning level post-graduation

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat