Get instant loan offer suitable to your profile !

.webp)

On this Page:

Learn how to secure an education loan even with a low CIBIL score. Get tips and eligibility criteria, and explore alternative options to finance your education.

When a student is preparing for education abroad, they prepare for scores, letters of recommendation, and statements of purpose; they often lack guidance when it comes to the financial aspects. However, when things move forward and they apply for the education loan, they usually forget one thing: their CIBIL score. The CIBIL score required for an education loan is the primary factor that the lender verifies. Financial institutions often look for a credit score of 750 or above, as reported by CIBIL. If you have never withdrawn an education loan your CIBIL will be 0 or -1. Still, to understand the CIBIL score to the cor,e you can use the below information.

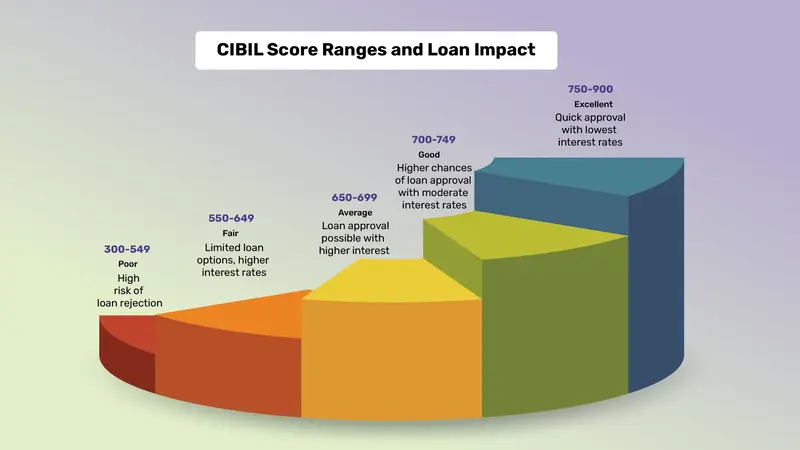

When a person withdraws a loan or gets a credit card, they create a financial history. However, the CIBIL score is built based on your repayment information whenever you borrow money. The CIBIL Credit score is a summary of your entire credit history in the form of a three-digit number. It normally ranges from 300 to 900 and is a representation of your creditworthiness. A higher score indicates that you are a less risky borrower, increasing your chances of availing a loan, whereas a lower score decreases that probability.

During the education loan, CIBIL score isn’t the primary factor that is verified. Instead, lenders check your Credit Information Report (CIR). The repayment history shows how good you are with your finances.

A credit report typically includes information such as personal identification details, credit accounts (credit cards, loans, mortgages), payment history, credit utilization, credit inquiries, and public records (such as bankruptcies or tax liens). This history is even used to check and confirm the obligations you have on your income. So, if you still think that, Is CIBIL score required for education loan? Of course! Yes.

Your Credit Information Report (CIR) and six months of financial data are used to calculate the CIBIL score. The CIBIL algorithm calculates the CIBIL credit score based on 258 different variables, each having an appropriate weight. But the five primary factors that can be controlled by you are mentioned below:

When applying for an education loan, especially unsecured education loans, the co-applicant or guarantor's CIBIL score (or credit score) becomes a critical factor. It indicates the creditworthiness of the borrower and/or co-applicant. This also impacts the approval and terms of the loan.

Besides the CIBIL website, you can also check your CIBIL score through various third-party financial service providers like:

Many of these platforms offer free CIBIL score checks without affecting your credit rating.

CIBIL scores can vary from 300 to 900, with 900 indicating the highest level of creditworthiness. Having a CIBIL score of 750 or above on your credit report is ideal, as it enhances your eligibility for loans and credit cards.

| CIBIL score range | Education loan approval chances |

|---|---|

|

< 600 |

Low |

|

600 - 649 |

Difficult |

|

650 - 699 |

Possible |

|

700 - 749 |

Good |

|

750 - 900 |

Very high |

There are both pros and cons of the education loan CIBIL score which you might not know. We have listed them below:

| Factor | Pros | Cons |

|---|---|---|

|

Accessible |

Education loans can get approved even with low scores. |

The approved loan amount can be slightly low as compared to the required amount. |

|

Lenders |

Multiple lenders can approve your loan application. |

Public and Private banks ask for an additional guarantor. |

|

Interest Rate |

The charged interest rate is 13-14%. |

The charged interest rate is higher as compared to the applicant applying with good CIBIL. |

|

Co-applicant |

The co-applicant CIBIL can improve your profile. |

It might impact the co-applicant CIBIL if you default the EMI. |

|

Repayment During Moratorium |

Full simple interest and Full EMI are available. |

Can’t choose the full moratorium option. |

When you are applying for a loan not just an education loan, the CIBIL score impacts your approval and interest rate. Statistics show that on average, 90% of the loans are granted to applicants with a score above 750. The higher the score, the higher the probability of getting your loan approved, and a study loan is no exception to this rule. Having a good credit score has its perks including:

Thus, when it comes to education loans, the CIBIL score is a crucial factor in the loan approval process. The minimum CIBIL score for an education loan is 650.

The majority of the students might not have taken a loan or credit card in the past and thus don’t have any credit history. In such cases, when they apply for an education loan, the lender checks the credit history of the co-applicant who usually are, their parents. Thus, if the parents have a low CIBIL score, there is a high chance that the loan can be denied.

One of the most popular questions related to low CIBIL scores is - “Is CIBIL score required for education loan ?” All the reasons mentioned above answer this question. Yet, the most basic thing that people are confused about. Can a student withdraw an education loan without CIBIL score? So, the answer is that when the student or co-applicant doesn’t have a credit history.

The CIBIL score becomes 0 or -1 which is considered positive and the loan is approved quickly in this case. These scores are considered equivalent to the 750 CIBIL score therefore, you don’t need to run for a credit card to get an education loan.

If you are applying for an education loan with low CIBIL score then you can apply for a minimum CIBIL score for education loans is 650. However, even at CIBIL 650, it will be very difficult for you to get an education loan. CIBIL scores above 700 are generally considered for an education loan. For low CIBIL scores, lenders charge high interest rates, which can cost you lakhs in the long run.

If you are applying for an abroad education loan with low CIBIL score then you can use the following ways to avoid rejection from the lender:

A good income will prove to the lender that the applicant can repay the loan. Even with a bad credit score, proof of income shows that the borrower is adequately financially stable to repay the loan.

Sometimes, the CIBIL score is affected if you miss the credit card bill payment on time. Thus, it impacts your credit score. You will become an education loan for CIBIL defaulters in a day. To avoid thi,s you can get the No Objection Certificate (NOC) from the lender to get your approval letter.

Many lenders consider spouses, siblings, and other blood relatives as co-applicants. So, if your current co-applicant has a low CIBIL score, then you can change the co-applicant to make your loan application better.

Secured loans are already safeguarded using the asset; hence, using the secured loan option, you can get an education loan. In a secured loan, the co-applicant's financial profile is not the primary factor but a secondary factor that might influence it. But it won’t have too much impact.

The best method to ensure your bad credit score doesn’t ruin your chances of getting a loan is to resolve the errors. A mistake or an error in the report can also occur. Review your credit report every six months to ensure this doesn’t happen again.

Banks tend to scrutinize the loan application rigorously. Whereas, NBFCs might relax some policies if the student’s profile is outstanding.

It is a little difficult to get an education loan for a low CIBIL score, but fortunately, not impossible. Here are some tips on how you can avail abroad education loan when you have low CIBIL score:

If you have a low CIBIL score but require an education loan to pursue your higher education abroad, so, here are some alternative lending options through banks. These lenders are more flexible and offer education loans even to students with lower credit scores.

A non-banking financial institution is not legally a bank, however, it is regulated by the national and international banking agencies. It has some lenders who accept education loan applications if an applicant has a low CIBIL score.

Some fintech lenders like Auxilo, TATA Capital, and MPower also provide education loans. They have their set of eligibility criteria and categories, which help many low CIBIL students secure an education loan.

Education loan with low CIBIL scores are not impossible to get however, they also come with lots of challenges. They are as follows:

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat