Get instant loan offer suitable to your profile !

On this Page:

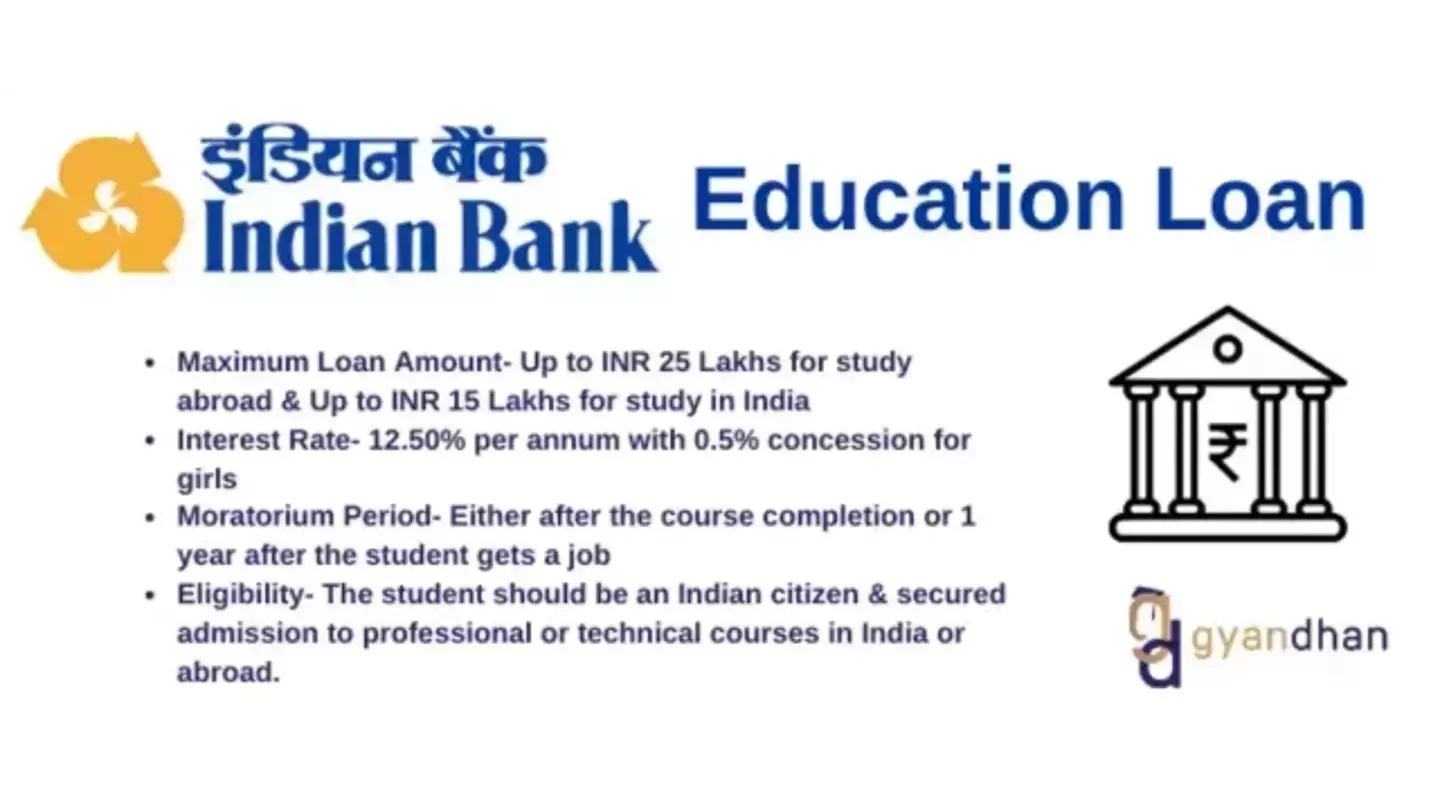

Check Complete information about Indian Bank education loan for studies in India & abroad. Know about Interest Rates, How to Apply, and Documents Required.

Did you know that in the last 10 years, the number of students taking abroad education loans from public sector banks has increased three times and similarly the loan amount being sanctioned has also increased six times. One of the major players in this overall increase is the Indian Bank and its abroad education loan offering. For the FY 2021-22, the Indian Bank disbursed around 284 Cr to students who wanted to study abroad. The average lending amount comes to 11 Lakh per student. In order to provide you with more clarity on Indian Bank education loan details, process and its offering, we have compiled all the information and integrated it into this blog.

Check Your Education Loan Eligibility

Founded in 1907, Indian Bank has established a robust network of branches spanning across the entire nation. However, a pivotal development took place in 2020 when Indian Bank merged with Allahabad Bank. This merger had the consequential effect of transferring all customers of Allahabad Bank to Indian Bank, effectively bringing an end to the independent operations of Allahabad Bank. Indian Bank provides education loans to study both in India and abroad as well.

Following are the education loan eligibility in Indian Bank that you need to fulfill in order to get Indian Bank education loan. There can be more specific criteria, which banks can put in front of you while applying. The general criteria are -

You should be an Indian student with a minimum age of 18 years or above.

You should be an Indian student with a minimum age of 18 years or above.

You should have a good past academic score.

You should have a good past academic score.

Must have cleared all necessary tests like IELTS, TOEFL, GRE, or GMAT.

Must have cleared all necessary tests like IELTS, TOEFL, GRE, or GMAT.

Should be admitted to a reputed university abroad.

Should be admitted to a reputed university abroad.

Eligible courses - full-time graduate/postgraduate courses, PG diploma courses, and more.

Eligible courses - full-time graduate/postgraduate courses, PG diploma courses, and more.

The target universities should be selected from institutes ranked within the top 1,000 colleges according to the latest World Ranking issued by the bank's accepted websites.

The target universities should be selected from institutes ranked within the top 1,000 colleges according to the latest World Ranking issued by the bank's accepted websites.

The different expenses that will be covered when by Indian Bank Education loan will be -

Tuition Fees

Tuition Fees

Accommodation charges

Accommodation charges

Travel expenses

Travel expenses

Living cost

Living cost

Purchase of study-related materials like books, laptops, or more.

Purchase of study-related materials like books, laptops, or more.

Registration or subscription fee for things like library, laboratory, and more.

Registration or subscription fee for things like library, laboratory, and more.

Any other charges or costs like security deposit, healthcare, or any other important thing.

Any other charges or costs like security deposit, healthcare, or any other important thing.

This bank just like other public sector banks is preferred when an individual needs to take a secured education loan that is a loan with collateral. The main reason for this preference is that when you decide to take a secured education loan then the loan amount that can be approved is more, the interest rate is low, and more such benefits. The details of Indian Bank education loan are given below -

| Feature | Detail |

|---|---|

|

Loan Amount |

7.5 Lakh to 100% of collateral value |

|

Minimum age of the applicant |

18 years |

|

Interest rate type |

Floating |

|

9.20% - 11.40%* |

|

|

Interest rate incentive |

0.50% for female applicants |

|

Loan Tenure |

15 years |

|

Course + 12 months |

|

|

Payment during the moratorium period |

May require SI only |

|

Processing time |

10 - 12 days |

|

Yes |

|

|

Prepayment penalty |

No |

|

15% |

*Indian Bank education loan interest as of 2023

The different documents that will be required in order to apply for an Indian Bank education loan are -

Address proof: passport, voter ID, electricity bill, etc.

Address proof: passport, voter ID, electricity bill, etc.

Academic record: 10th/12th mark sheet for undergrad students and graduation degree & mark sheet for PG students.

Academic record: 10th/12th mark sheet for undergrad students and graduation degree & mark sheet for PG students.

Age proof

Age proof

Community certificate

Community certificate

Family income proof: ITR, salary certificate, pension certificate of parent/guardian.

Family income proof: ITR, salary certificate, pension certificate of parent/guardian.

Admission certificate or I20 from the college/university

Admission certificate or I20 from the college/university

Tuition Fee details

Tuition Fee details

Collateral documents (if applicable): LIC policy, valuation certificate, registry documents, etc.

Collateral documents (if applicable): LIC policy, valuation certificate, registry documents, etc.

An affidavit declaring that no study loan is availed from any other bank by the student and his/her parents.

An affidavit declaring that no study loan is availed from any other bank by the student and his/her parents.

Wondering - How to get education loan in Indian Bank? The application process for the Indian Bank education loan is simple. You can apply for the loan by visiting the branch directly, or you can also apply via an online application form and then move forward as required by the bank officials. The steps for the same are -

1. Visit the Indian Bank’s website.

2. From the options given on the horizontal bar, choose the product and then choose the loan product.

3. Once you have clicked on it, you will see different loan products that are offered by Indian Bank.

4. From the given list you will have to choose the education loan option.

5. A new page will open in which you will find an option “Apply for Loan”, click on it, and then you will be redirected to a new page.

6. Fill in the required details and attach the required documents. Once all of this is done your application can be successfully submitted to the bank.

Choosing the perfect lender requires careful consideration of various factors to meet your specific requirements. Public sector banks are a reliable option for education loans with collateral, but alternatives like SBI and UBI offer competitive rates. Therefore, it's essential to evaluate factors such as interest rates, loan amounts, eligibility criteria, margin money, processing fees, and more before finalizing a lender. We understand that assessing all these factors can be challenging, which is why GyanDhan is here to assist you in finding the best lender tailored to your needs. All you need to do is check your eligibility, and you can secure your abroad education loan with ease.

Calculate your Education Loan EMI

Yes, you can get an educational loan in Indian Bank with and without collateral. You can get up to 7.5 Lakh without collateral whereas with collateral you can get up to 100% of your collateral value.

Education loan interest rate Indian Bank offers can range between 9.20% - 11.40%. The interest rate that you can get depends on the application profile, targeted university/college, country, and more.

You can get your loan approved via Indian Bank in about 15-20 working days once all the documents have been submitted to the bank officials.

Female applicants are eligible for an interest rate concession of 0.50% on the applicable interest rate.

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat