Get instant loan offer suitable to your profile !

On this Page:

The ups and downs of Indian Rupee with respect to USD creates a lot of problems to the Indian Students planning to study in the US. Read out the tips to manage the impact of depreciating rupee and the extra cost.

Before moving ahead with the reasons for depreciating rupee, and its effect on the abroad education loan segment, let’s understand that these are temporary situations, and they aren’t going to hurt in the long run. However, if the situation doesn’t get right in due time, it might increase the cost of education abroad in recent times. So, we will start with the general explanation and then delve into its impact on the sector of our concern.

First, the RBI controls the rupee’s valuation to a limited extent, but the whole picture is much broader. The valuation of a currency depends on a ton of factors, and no one incident or policy decision can suddenly change the valuation of currency. Earlier, most of the countries used to decide the value of their currency on their own, but as markets grew, globalization happened, and free-market economies started surfacing, the countries moved to the floating exchange rate regimes. In floating exchange rate regimes, the forex market decides the valuation of a currency, not the government. The RBI shifted to this new exchange regime from 1994 and adopted the floating exchange rate regime with inflation as the target.

Now, we understand that the currency exchange rate is not something that the government or the RBI can control. It’s very important to know the factors that affect the valuation of the Indian rupee at this point in time. The COVID-19 pandemic brought the world to a crashing halt, the markets stopped working, the supply chain was disrupted, the demands in several sectors collapsed, the hospitality industry witnessed a major crisis, and the list is perhaps endless. All these factors combined crushed the global economy. The countries with stable economic foundations were able to bear its brunt, and the moderate ones received a big blow while the fragile economies collapsed. The Indian economy is in the moderate category because it received the blow of the pandemic, which resulted in the growth dipping to -23%. However, due to a stable government, moderately good economic foundation, demand due to its population somewhat protected it and brought it back on track.

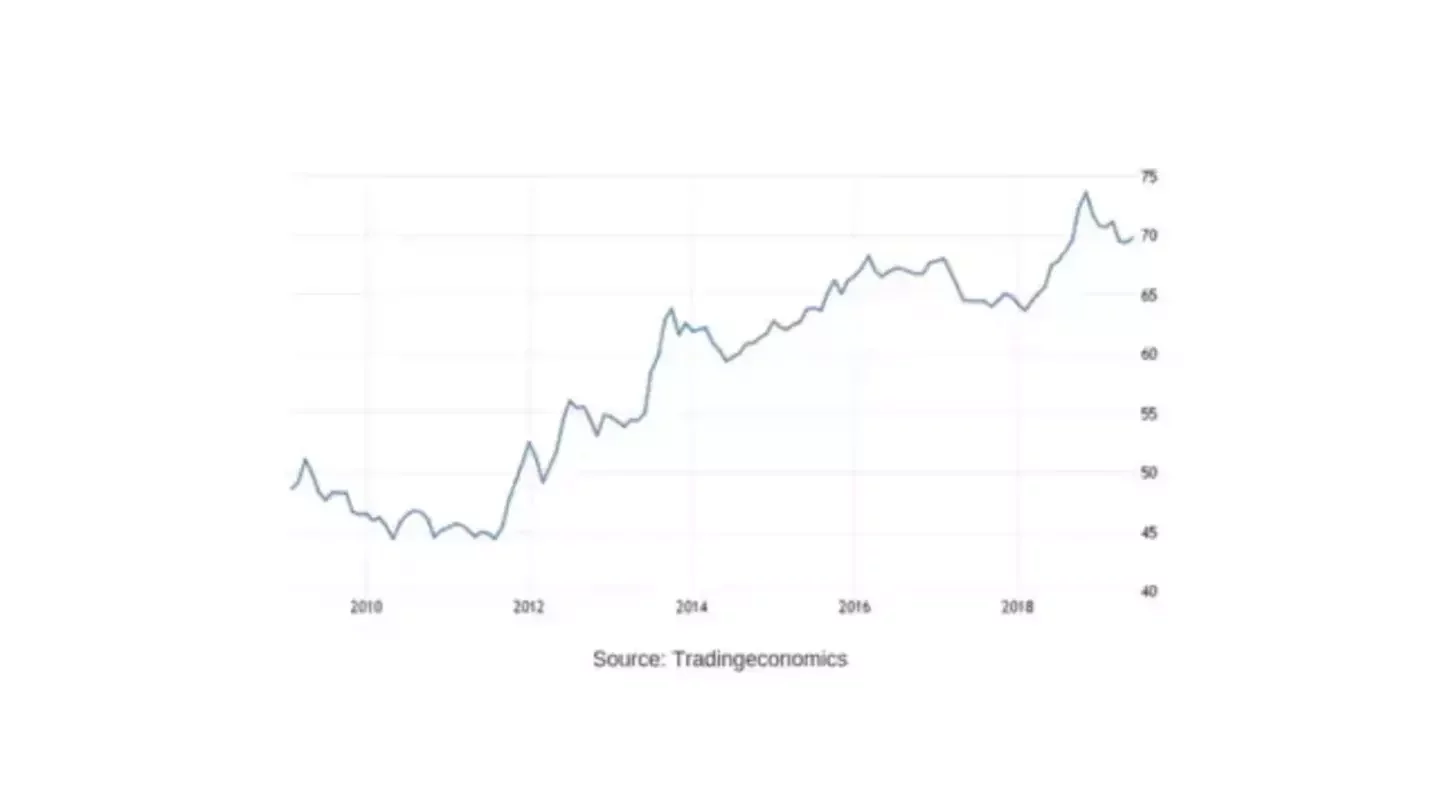

But the real problem began when new variants started coming in, and lockdowns were imposed again, and the hospitalizations increased. At the same time, the global markets also went down while crude oil prices reached an all-time high due to a sudden rise in demands across the world. This led to the widening of the current account deficit (in simple terms, a situation wherein the imports increased and exports decreased). Meanwhile, the US Central Banks, i.e. the Federal Reserves, adopted policies that strengthened the dollar. There was also a considerable outflow of capital from emerging markets like India, which further plummeted the Indian rupee. So, these are the factors that affected the Indian rupee, and it has touched a new low of 76.32.

Check Your Education Loan Eligibility

One of the consequential effects of the falling rupee can be understood in simple terms: for buying anything that cost $1 last month, one has to spend INR75, and for that same item today, one has to spend INR76. So, this is an explanation that everyone can understand. But when one sees this with respect to abroad education loans, the impact could be way more than what has been explained in the example above. The loan amount for education abroad is usually pretty high, and it can run into crores. When the loan amount is so significant, even a slight depreciation of the rupee will cascade the abroad education loan.

Usually, people see abroad education loans in narrower terms and think of it as the payment of tuition fees. Earlier, this used to be the case, but now the abroad education loans are much more comprehensive than mere payment of tuition fees. Now, they give comprehensive coverage and include almost all the student’s expenses in abroad studies. The covered expenses include the cost of living, the airfare, the insurance cost, the cost of stationery, buying laptops and computers, etc. The cost of everything increases every time the rupee plummets by certain points. All the expenses that are mentioned above are affected, and the overall cost incurred on these expenses increases.

Seeing it from the perspective of individual payments that one has to do, its effect can be understood more clearly. If the tuition fee for a particular course at Stanford University is $40,000 per semester, then, in that case, an Indian student has to pay INR 30,00,000 when 1USD= 75 INR, and when 1USD= 76 INR, then the same student has to pay 30,40,000. A straight increase of INR40K per semester. Here we have discussed only one aspect of the cost of education, i.e. the tuition fee. If we add all other costs covered under the cost of education, it can bring a significant change in the loan amount. So, a one rupee depreciation can have such a massive impact on the overall cost of education. A student from a middle and lower-middle-class family might have to rethink their study abroad plan if they haven’t planned well in advance. One must prepare for all the eventualities because the dynamic payments like the cost of accommodation, the cost of food, and other expenses are to be taken care of on a monthly basis.

As such, there is no direct way to escape from it, but there are certain things that one can do to minimize its effect to the maximum possible extent. One of the first and foremost things that one can do is to choose a destination where the tuition fee is low and the level of education is the same. One of the finest choices in this regard is the public universities in France, Germany, Switzerland, where most of them are either free or with a minimal tuition fee. The cost of living in Europe is certainly higher than any other continent, but if one can get a waiver on the tuition fee, the cost of education comes down considerably. The cost of living can be managed to an extent by working part-time, cutting down on unnecessary expenses. However, one should always bear in mind that this doesn’t mean that they don’t have to take an abroad education loan, as countries want assurance of financial stability before giving student visas. But choosing a university that has less tuition fees can be of great help.

Another possible way to mitigate the impact of the falling rupee is to take a loan of an additional education loan. Being low on expenses is something that can be a big-time hurdle to securing admission to a foreign university. So, the question is, what an additional education loan is? There are times when students are low on expenses, but there is a way out in the form of an additional education loan which is calculated on the current outstanding amount with the bank and the maximum loan amount that the borrower can avail. But this is restricted to secured loans only, and those with unsecured loans don’t have this option. If there is no option of taking a second loan from the bank, the student can always go to another NBFC or bank, for that matter, in order to get the second loan. If the reason warrants and the borrower’s needs can be justified, then the chances are likely that they may get the second loan. There is another option wherein a borrower can apply for a transfer of the loan from the old to the new bank. There are NBFCs like Credila and Avanse that help students with refinancing or top-up loans.

Check Your Education Loan Eligibility

Top-up loans and refinancing are certainly a good choice, but not everyone can afford the terms of repayment. For taking the loan, one might have to pledge collateral. Even after pledging the collateral merit and creditworthiness, one must fulfill other criteria to get the refinancing. Also, the rate of interest is very high for these loans. In fact, it can be more than 15% in some cases. So, one must think carefully before taking this loan as its implications will be felt at the time of repayment of loans.

Another thing that students can do is to choose a floating interest rate. Since bank interest rates also change with the factor mentioned above. A loan that is on the floating interest rate will benefit from the change in rates by the RBI, which is directly linked to inflation and other related factors. However, the banks themselves have now switched to floating interest rates, and in most cases, it is the default interest rate type.

And, the last but the best way out to actually extinguish the effect of the depreciation of the rupee is to apply for a scholarship and get one. There are several types of scholarships available for students from different backgrounds. There are private organizations, trusts, government-based scholarships for meritorious students. These scholarships, at times, even cover the living expenses and airfare. A falling rupee is one thing over which the students don’t control. So, it’s in the best interest of the students to choose a way out to ward off as many uncertainties as they can in the journey of their education abroad.

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat